The renewable energy transition and political stability in the MENA region

The International Energy Agency (IEA) expects global oil demand to start a slow decline over the next decade, driven by rising renewable energy use and the electrification of transportation and heating.

This article explores how declining oil demand may affect political stability in oil-rich Middle East and North Africa (MENA) countries. While many of them remain among the world’s lowest-cost producers, falling prices could strain their public finances. If oil revenues decline structurally, some regimes may struggle to fund public services and maintain legitimacy.

Governments face a choice: delay socioeconomic reforms to avoid short-term unrest – risking long-term vulnerabilities – or pursue disruptive changes to build long-term resilience. Striking a balance will be a major challenge for oil-rich MENA countries in the coming decade.

In its recently published report Oil 2025, the International Energy Agency (IEA) announced that it expected global oil demand to peak by 2029. Alongside the electrification of transportation and heating, a key driver of this trend is the growing share of renewable energy in global power generation. This forecast is in line with similar reports, such as the 2024 BP Energy Outlook, which takes a longer-term view to 2050. Rystad Energy projects that oil demand will peak sometime between 2025 and 2037, depending on the pace of the energy transition. However, there are also other voices: OPEC1 Secretary General Haitham Al Ghais declared recently that “there is no peak in oil demand on the horizon”.

For many oil-rich countries, the precise date of “peak oil demand” is less important than the widening gap between supply and demand, which may exert long-term downward pressure on oil prices. On the one hand, new suppliers such as Argentina, Brazil or Guyana are adding to global supply; on the other, demand is widely expected to decline from a certain point on. This shift towards a buyers’ market - where oil-rich countries must compete for export opportunities - risks structurally lowering prices and eroding the economic rents on which these states have long depended.

A number of academic texts have shown a connection between oil prices and political stability. Some studies have established a link between decreasing oil prices and protests, coups d’état or conflict escalation. Other studies have argued that countries become more democratic when they have passed their oil peak. In many oil-rich countries around the world (e.g., Kazakhstan, Saudi Arabia or Venezuela), often defined as rentier states, the degree of political stability relies significantly on revenues generated from hydrocarbons. These revenues are used in various ways: to fund repressive state apparatuses, to maintain clientelist networks, or to provide economic benefits to citizens in order to secure public support for the political status quo. In general, declining oil prices are associated with rising political instability, as they weaken the state’s capacity to govern effectively and undermine regime legitimacy. However, it is important to recognise that factors such as existing political stability, institutional quality and the economic profile significantly moderate this relationship.

Bringing these two dynamics together, this issue of Notes Internacionals examines the extent to which the global renewable energy transition may impact the political stability of oil-rich countries in the Middle East and North Africa (MENA).

The renewable energy transition is defined here as “a pathway toward transformation of the global energy sector from fossil-based to zero-carbon by the second half of this century”2. For the purposes of this paper, “oil-rich countries” refers to those in the MENA region where oil rents account for more than 10% of GDP (according to the World Bank). This group includes the seven Arab countries of the Arabian/Persian Gulf (“the Gulf”), that is, Bahrain, Iraq, Kuwait, Oman, Qatar, Saudi Arabia, the United Arab Emirates, as well as Algeria, Iran and Libya. Political stability, meanwhile, is understood as “the health of authority, resilience, legitimacy, and replacement in a political object”, that is, a regime is considered stable if it can enforce its rule, adapt to change, maintain perceived legitimacy and provide for the peaceful and orderly replacement of leadership.

The renewable energy transition in the MENA region

When discussing the renewable energy transition, it is important to recognise that this process is not driven solely by environmental concerns, but also increasingly by geopolitical and economic considerations. Expanding domestic energy production through sources such as solar and wind allows countries - particularly those with limited fossil fuel reserves - to reduce their dependence on external energy suppliers. At the same time, renewable energy has become increasingly cost-competitive, usually offering lower generation costs compared to fossil fuel-based energy. These two parallel drivers - energy security and lower generation costs - ensure that renewables can even be politically attractive when climate change is not a top priority for political leadership. As a result, most leading energy models project continued rapid growth in renewable energy generation across the world (2024 BP Energy Outlook, IEA World Energy Outlook 2024).

However, further expansion of renewable energy generation does not automatically imply a decrease in fossil fuel demand. In fact, we are still in a phase of “energy addition” rather than “energy substitution”: the share of renewables is growing rapidly, but not fast enough to keep up with the growth in total global energy demand. A common expectation is that the substitution phase will begin in the 2030s. Yet this will not be an abrupt change, and the decline in oil demand is expected to be very gradual with phases of volatility. Historically speaking, energy transitions are very slow processes, and, as the influential energy analyst Daniel Yergin argues, this one will probably “not proceed as many expect or in a linear way: it will be multidimensional, proceeding at different rates with a different mix of technologies and different priorities in different regions”. The BP Energy Outlook 2024, for example, projects that oil demand will plateau between 2025 and 2030, yet still forecasts that, under the current trajectory, global demand in 2050 will be roughly at the level it was in 2000. The persistence of existing fossil fuel infrastructure, continuous demand growth in many parts of the world, technological limitations of renewables (e.g. reduced dispatchability) and ongoing oil dependency in sectors such as petrochemicals, aviation, shipping and heavy industries all contribute to a substantial demand for oil in the foreseeable future (see also IEA World Energy Outlook 2024).

For these reasons, most oil-producing countries in the Gulf region are not particularly concerned that they will run out of markets for their resources anytime soon. Furthermore, their production costs are among the lowest in the world, and many still possess abundant reserves. As a result, they are often expected to be the “last men standing” even in a future where oil prices fall below the commercial breakeven point for higher-cost producers. In such a scenario, extraction methods that are more expensive - such as deep-sea drilling, fracking or operations in remote, harsh environments - will be the first to cease production due to economic viability. According to Rystad, the lowest average breakeven price for new oil production is found in onshore operations in the Middle East, at just $27 per barrel. This is followed by offshore shelf production at $37 per barrel, deepwater offshore at $43, and North American shale at $45. In contrast, oil sands have significantly higher breakeven prices, averaging around $57 per barrel, with some projects reaching up to $75. Most MENA producers argue that their competitive advantage will shield them from the effects of global demand decline and that their market share will even increase.

However, broader market dynamics could still pose significant challenges. As global demand declines and oversupply becomes more likely, high-cost producers may face strong incentives to maximise output in the short term - a pattern often described as a “feast before the famine.” In such a situation, low-cost producers could decide to constrain their output to stabilise the price. A potential risk of this strategy is, however, that the higher the oil price, the greater the economic incentive for public and private actors to seek cheaper alternatives. Investments in renewables often rise when oil prices are high and decrease when prices fall again.

Furthermore, in a market with shrinking demand, this strategy will be difficult to sustain, as individual high-cost producers face strong incentives to break ranks and monetise their reserves quickly, fearing they may soon become stranded and lose economic value. This behaviour, akin to a resource-based prisoner’s dilemma, would lead to a breakdown of coordination, intensified competition, overproduction and a downward spiral in prices. In 1986, a similar dynamic played out when Saudi Arabia - after years of unilaterally cutting output to support global oil prices - abandoned its role as swing producer in response to other OPEC members exceeding their quotas. This shift led to a sharp increase in global supply and a subsequent price collapse. It took more than 15 years for oil prices to return structurally to pre-crash levels. This recovery was driven primarily by surging demand from a rapidly growing Chinese economy, which is a scenario that is unlikely to be repeated. Due to these dynamics, Rystad Energy expects that oil prices in the future will be structurally lower than the $80 per barrel OPEC is aiming for.

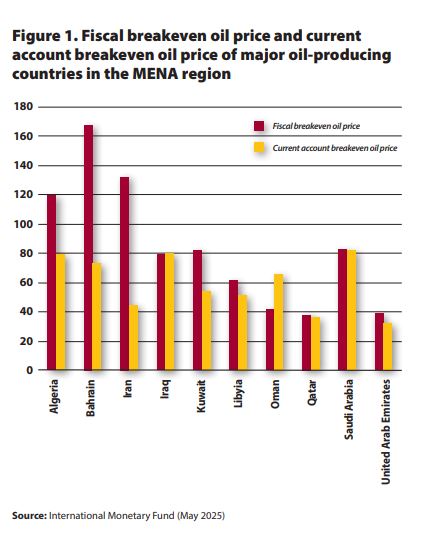

While countries in the Gulf have some of the lowest oil production costs in the world , they often require high oil prices to balance their national budgets. Due to high levels of public spending - on subsidies, public sector wages and large-scale development projects - most of them have high fiscal breakeven oil prices (see Figure 1). According to the International Monetary Fund (IMF), nearly all MENA countries require oil prices significantly above the current level (around $65 per barrel as of July 2025) to balance their budgets. If for a limited period the global oil price falls under this threshold, most oil-rich countries can fill the gap with financial reserves or low-interest debt. But if it stays structurally low for a long period, they will need to cut public spending or disincentivise imports: a prospect that most governments like to avoid. In the 1980s, for example, Saudi Arabia weathered the storm by reducing capital spending, freezing infrastructure projects and delaying payments to suppliers in order to avoid cuts to the public sector. Such strategies, however, only work for a limited period of time and are no structural solution to less revenues.

In sum, most oil-rich countries in the MENA region, in the short to medium term at least, are not overly concerned about losing markets for their products. What poses a greater concern is the scenario in which oil supply outpaces demand, leading to price volatility and structurally lower prices that could result in chronic underfinancing of government budgets.

Possible policy reactions by oil-rich countries

The risks associated with declining oil demand are not new. Ahmed Zaki Yamani, long-time Saudi oil minister from 1962 to 1986 and a key figure in the formation of OPEC, famously remarked that “the Stone Age came to an end not for a lack of stones, and the Oil Age will end, but not for a lack of oil”. In other words, technological innovations can make a resource less important for markets.

Policy responses to this challenge have been around for many decades, focusing on economic diversification, fiscal reform and a reassessment of public spending. In the context of the renewable energy transition, these strategies remain the default approach for oil-dependent economies seeking to adapt to a changing global energy landscape.

“Kicking the can down the road”: short-term stability - long-term vulnerability

Despite widespread recognition of the long-term risks associated with fossil fuel dependence, many oil-rich countries remain reluctant to pursue meaningful economic diversification or structural reform in the short term. This hesitation is rooted in a combination of political, economic and institutional factors that make inaction appealing from the perspective of ruling elites.

For many, there seems to be no immediate time pressure. Global oil demand continues to rise and is not expected to decline significantly in the near future. Moreover, there is often widespread scepticism among policymakers about the speed and scale of the global energy transition, which further weakens the perceived urgency for reform. In Kuwait, for example, until recently, diversification efforts have only been pursued halfheartedly as many policymakers and the population saw no urgency for structural changes at the moment. Furthermore, political gridlock made it difficult to strike a grand bargain over the country’s future. As long as oil revenues continue to finance public spending, or gaps in the budget can be filled with financial reserves or low-interest debt, there is little incentive for governments to take politically unpopular steps. In other cases, such as Algeria, Iraq or Iran, the domestic political context is already highly volatile - marked by relatively recent public protests - so governments must tread carefully when implementing major reforms.

Introducing structural reforms can threaten the delicate social contract that underpins many rentier states. These reforms often involve difficult trade-offs, such as reducing subsidies, introducing taxes or restructuring bloated public sectors. In political systems where citizens expect generous state benefits, low taxation and secure public employment in exchange for political compliance, tampering with these expectations can provoke public discontent and elite resistance. From this perspective, reform poses greater short-term political risk than maintaining the status quo.

Furthermore, reform can undermine the power and patronage networks of incumbent elites. Rather than risk disruption to their authority, many rulers prefer to “muddle through”, using oil revenues for short-term appeasement measures such as cash transfers, salary increases or new subsidies (see, for example, the response of most oil-rich countries in the region to the Arab Spring). This strategy allows them to postpone difficult decisions while safeguarding their hold on power. Inviting foreign investors, privatising state-owned companies and implementing similar policies can undermine state sovereignty and weaken the exclusive control of incumbent elites over state resources.

Overall, governments in oil-rich countries have several incentives to adopt a wait-and-see approach. Even when aware of the long-term necessity of reform, they may prefer to observe how other comparable states implement change - learning from their successes and failures - before embarking on potentially disruptive transitions themselves. From their perspective, premature reform could ultimately do more harm than good. Moreover, when decision-makers are already of an advanced age they may prioritise short-term stability over long-term planning. Yet this approach comes with considerable risks for the resilience of these countries in the long run.

One big unknown is the pace of the energy transition. While the aforementioned models may be relatively accurate for the near term, their predictive power decreases the further one looks in the future: technological innovations may overcome some of the current limitations of renewable energy, unexpected events may shake up the global economy or governments may push more ambitious objectives than now. In fact, if the world really did go for a “net-zero” strategy, global demand in 2050 would only be one-third of today’s demand, compared to 80% on the current trajectory.

Without reform, oil-dependent economies risk stagnation and falling behind as the global economy shifts toward green technologies, digitalisation and new industrial models. In a non-diversified economy, declining oil revenues - whether due to price drops or reduced demand - will increasingly strain state budgets. In many rentier states, where oil income dominates public finances, this may lead to deficits, mounting debt or the slow depletion of sovereign wealth funds. As fiscal space tightens, governments may need to resort to austerity measures, which can provoke public backlash, especially in societies where state benefits are expected and private sector opportunities are scarce. Rising youth unemployment and inequality can heighten tensions, fuelling protests, political mobilisation or even violent unrest.

Besides economic and social risks, continued inaction threatens political legitimacy. Many oil-rich regimes rely not on democratic institutions but on wealth distribution to maintain authority. When that capacity weakens, so does the credibility of the ruling elite. In authoritarian or semi-authoritarian systems, the lack of political outlets can turn economic discontent into broader regime challenges.

In short, while inaction may reduce short-term political risk, it increases long-term vulnerability. Oil-rich countries that fail to diversify and reform now may face not only economic decline but also social turmoil, political instability and strategic marginalisation in a world where oil is becoming less valuable.

“No pain, no gain”: short-term disruption, long-term stability

While the risks of inaction are real and growing, meaningful reform is also not without costs, particularly in the short term. Structural transformation in oil-rich economies often requires painful adjustments that can provoke resistance and unsettle the political status quo. Efforts to diversify the economy, reduce public spending or introduce new taxes directly challenge the expectations of citizens and elites who have long benefited from the rentier model. These reforms may lead to social unrest, internal power struggles or temporary economic dislocation, particularly in countries where state-led redistribution has long served as a substitute for political participation. Ultimately, changing the socioeconomic status quo implies a renegotiation of the social contract in these countries.

Nonetheless, several governments in the MENA region have begun to acknowledge that the current model is unsustainable in the long run. The United Arab Emirates is the pioneer and has already set out big steps towards a more diversified economy, while Saudi Arabia has also launched an ambitious vision for economic diversification, investment in non-oil sectors and the expansion of domestic renewable energy. These strategies by oil-rich countries are not just economically motivated but reflect a recognition that continued dependence on oil leaves them vulnerable to external shocks and global market shifts. In essence, they have acknowledged the inherent risk of building political stability on an unstable commodity. Matthew Gray has characterised this system as “late-rentierism” in the Gulf: countries seek to move away from their reliance on oil exports and embrace economic liberalisation, new technologies and some social changes, while preserving the political status quo. Yet it is important to keep in mind that these policies do not imply a move away from fossil fuels: most oil-producers in the MENA region are even doubling down on oil exports. Some of them are promoting renewable energy themselves, but this energy is mainly used for domestic consumption to free up more hydrocarbons for exports. To quote Saudi Arabia’s Energy Minister Prince Abdulaziz bin Salman: “We are still going to be the last man standing, and every molecule of hydrocarbon will come out”. While these reform efforts have faced implementation challenges and critiques of top-down control, they signal an important shift in mindset: that long-term stability may only be achievable through short-term disruption.

Indeed, countries that embrace reform early may be better positioned to manage the energy transition on their own terms. Investing in education, building competitive industries, modernising state institutions and fostering private sector growth are not achieved overnight and often long processes. If successful, these measures can enhance state resilience, expand the social contract beyond rent distribution and create new sources of legitimacy rooted in performance, opportunity and innovation. Although more politically risky in the short run, such reforms offer a pathway towards greater long-term stability. In other words, the time to fix the roof is when the sun is shining

Conclusion

In the end, the impact of the renewable energy transition on the political stability of oil-rich countries in the MENA region depends a great deal on the individual characteristics of each country. The stability of most of the Gulf countries with state-of-the art oil production technology, well-functioning institutions and political constancy does not seem to be at much peril in the short and medium term. In fact, thanks to their low production costs, their market share is likely to increase. While this gives these countries more time to make a smooth transition to a more diversified economy, it also creates stronger incentives for inertia.

On the other hand, countries with higher fiscal breakeven prices and a history of political instability - such as Algeria, Iraq or Iran - are more vulnerable to declining oil prices. Their economies are more sensitive to revenue shocks, which can, in turn, translate into political volatility.

Political leaders of oil-rich MENA countries now face a strategic crossroads: they can either double down on the existing rentier model, relying on sovereign wealth funds and low-cost production to weather short-term shocks for the moment, or pursue structural reforms to build more resilient and diversified economies.

The former path may provide short-term stability but carries substantial long-term risk, particularly if global demand erodes more rapidly than anticipated. The latter route - while politically and socially riskier in the short run - offers a more sustainable future if implemented thoughtfully. Such action demands political foresight to implement potentially unpopular reforms proactively, prioritising long-term stability over short-term convenience. A successful transition requires more than just new infrastructure; it demands long-term investment in education, the economy and a gradual cultural shift that redefines the social contract beyond rent distribution. The optimal approach lies in a reform process that moves decisively in the right direction yet carefully avoids triggering major political or social upheaval. Finding this balance will be a major challenge for oil-rich countries in the MENA region in the next decade.

Notes:

1-Organization of the Petroleum Exporting Countries (OPEC).

2-See International Renewable Energy Agency (IRENA).

This paper is part of the project “OILDOWN: The Implications of Decreasing Fossil Fuel Demand for Political Stability in the Middle East and North Africa”. OILDOWN is funded by the Spanish Ministry of Science and Innovation programme “Strategic Projects on the Ecological Transition and Digital Transition” (Grant number: TED2021-132846A-I00). The author would like to thank Eckart Woertz for his valuable feedback on an earlier draft of this paper.

E-ISSN: 2013-4428

DOI: https://doi.org/10.24241/NotesInt.2025/320/en

All the publications express the opinions of their individual authors and do not necessarily reflect the views of CIDOB or its donors